Best Day Trading Guides to Buy in February 2026

How to Day Trade: The Plain Truth

Day Trading For Dummies

Trading: Technical Analysis Masterclass: Master the financial markets

- MASTER FINANCIAL MARKETS WITH EXPERT TRADING TECHNIQUES TODAY!

- PREMIUM QUALITY MATERIAL ENSURES DURABILITY AND LONG-LASTING USE.

- TRANSFORM YOUR TRADING SKILLS WITH THIS COMPREHENSIVE MASTERCLASS!

How to Day Trade for a Living: A Beginner's Guide to Trading Tools and Tactics, Money Management, Discipline and Trading Psychology (Stock Market Trading and Investing Book 1)

Trading in the Zone: Master the Market with Confidence, Discipline and a Winning Attitude

- ENGAGING READS FOR ALL BOOK LOVERS-IGNITE THEIR PASSION TODAY!

- IDEAL GIFT FOR AVID READERS-PERFECT FOR ANY OCCASION!

- CURATED SELECTIONS THAT ENHANCE ANY BOOKSHELF-SHOP NOW!

Best Loser Wins: Why Normal Thinking Never Wins the Trading Game – written by a high-stake day trader

A Beginner's Guide to Day Trading Online (2nd edition)

- QUALITY ASSURANCE: EACH BOOK IS INSPECTED FOR GOOD CONDITION.

- AFFORDABLE PRICES: ENJOY SAVINGS ON QUALITY USED BOOKS TODAY!

- ECO-FRIENDLY CHOICE: REDUCE WASTE BY CHOOSING PRE-LOVED BOOKS!

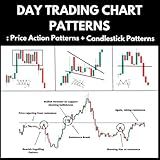

Day Trading Chart Patterns : Price Action Patterns + Candlestick Patterns

Day Trading QuickStart Guide: The Simplified Beginner's Guide to Winning Trade Plans, Conquering the Markets, and Becoming a Successful Day Trader (Trading & Investing - QuickStart Guides)

Options Trading: How to Turn Every Friday into Payday Using Weekly Options! Generate Weekly Income in ALL Markets and Sleep Worry-Free!

The Typical Price (TP) is a technical indicator used in day trading to analyze the average price of an asset during a specific trading period. It is calculated by adding the high, low, and closing prices of a candlestick and then dividing the sum by three.

The TP indicator helps eliminate some of the noise in the market by smoothing out price fluctuations. It provides traders with a more accurate representation of the asset's average price during a given timeframe.

Day traders utilize the Typical Price to identify trends, support and resistance levels, and potential reversal patterns. It is commonly used in conjunction with other technical indicators and chart patterns to make trading decisions.

When interpreting the TP, traders look for patterns or specific values that indicate potential buy or sell signals. For example, if the TP is consistently increasing, it suggests an upward trend and may be a signal to buy. Conversely, if the TP is consistently decreasing, it indicates a downward trend and may be a signal to sell.

Traders should be cautious when using the TP as the sole basis for trading decisions. It is important to consider other factors such as volume, market sentiment, and fundamental analysis to make well-informed trading choices.

Overall, the Typical Price is a valuable tool for day traders that provides a clearer understanding of an asset's average price over a specified period. By incorporating it into their trading strategy, traders can enhance their decision-making process and potentially improve their trading outcomes.

How to apply typical price in different market conditions?

Applying the concept of typical price in different market conditions involves analyzing and interpreting the data to determine the average or typical price of a given asset or security. Here are some steps to follow:

- Define the time frame: Determine the duration for which you want to calculate the typical price. It could be a day, a month, or any other time period depending on your analysis requirements.

- Gather price data: Obtain the historical price data of the asset or security for the chosen time frame. This data is typically available through financial websites, trading platforms, or professional data providers.

- Calculate the typical price: The typical price is often calculated as the average of the high, low, and closing prices for a particular time period. Follow this formula: Typical Price = (High + Low + Close) / 3

- Analyze market conditions: Assess the current market conditions to determine whether the market is trending, range-bound, volatile, or experiencing any particular patterns. This analysis can include examining indicators, studying price action, and considering other relevant factors.

- Compare typical price with current prices: Compare the calculated typical price with the current market price of the asset or security. If the current price is significantly above or below the typical price level, it may indicate unusual buying or selling pressure.

- Consider support and resistance levels: Take into account the support and resistance levels in the market. If the current price is close to a support level and below the typical price, it might indicate a potential buying opportunity. Conversely, if the price is near a resistance level and above the typical price, it could suggest a selling opportunity.

- Apply other technical analysis tools: Use other technical analysis indicators or tools like moving averages, trend lines, or oscillators to corroborate the analysis based on the typical price. These additional tools can enhance your understanding of the market conditions and potential price trends.

- Monitor price movements: Continuously monitor the asset's price movements and compare them to the typical price to spot any significant deviations or divergences. Such deviations may help identify overbought or oversold conditions, potential trend reversals, or market extremes.

Remember, the concept of typical price is one of many methods used in technical analysis, and its effectiveness can vary depending on the asset and market conditions. It is always recommended to combine it with other analysis techniques and indicators for a more comprehensive market assessment.

How does typical price differ from other price indicators?

Typical price is a price indicator that is commonly used in technical analysis to measure the average price of a security over a specific time period. It is different from other price indicators in the following ways:

- Calculation method: Typical price is calculated by adding the high, low, and closing price of a security for a given period, and then dividing the sum by 3. This provides an average price value that represents the overall price movement of the security.

- Focus on the average price: Unlike other price indicators that may focus on specific price points, such as the closing price or the high-low range, typical price takes into account multiple price points (high, low, and closing) and combines them to provide a single average value.

- Smoothens price fluctuations: By considering different price points, typical price can help to smooth out short-term price fluctuations and provide a clearer picture of the overall price trend. This can be useful for traders and analysts looking for a less volatile price indicator.

- Use in other technical indicators: Typical price is often used as an input for other technical indicators such as moving averages or oscillators. By providing an average price value, it can be used to generate signals or identify trends in combination with other indicators.

It's important to note that different price indicators serve different purposes, and traders and analysts often use a combination of indicators to gain a comprehensive understanding of market dynamics.

How to incorporate typical price into my day trading strategy?

Incorporating typical price into your day trading strategy can provide you with valuable insights about the average price of a security over a given period. Here are a few steps to help you incorporate typical price into your strategy:

- Calculation: Calculate the typical price by adding the high, low, and closing prices for a given period, and then divide the sum by three. This will give you an average price for that period.

- Timeframe selection: Determine the timeframe you want to analyze. It can be a single day, an hour, or any other timeframe that suits your trading style.

- Identify trends: Monitor the typical price over multiple periods to identify trends in the security's price movement. Look for patterns such as higher highs and higher lows in an uptrend, or lower highs and lower lows in a downtrend.

- Confirmation: Use the typical price as a confirmation tool. For example, if the typical price is consistently rising over a few periods, it might indicate a bullish trend, and you can consider buying when prices dip.

- Support and resistance levels: Compare the current price to the typical price to identify potential support and resistance levels. If the price is consistently above the typical price, it might act as a support level. Conversely, if the price is consistently below the typical price, it may serve as resistance.

- Combine with other indicators: Consider combining the typical price with other technical indicators like moving averages, volume, or oscillators to enhance your strategy and confirm trading signals.

- Backtesting and fine-tuning: Backtest your strategy on historical data to evaluate its effectiveness. Analyze the results and make any necessary adjustments to refine your trading strategy.

Remember, incorporating typical price should be only one part of your overall trading strategy. It's essential to consider other factors such as market conditions, risk management, and position sizing to make informed trading decisions.

What is the role of typical price in risk management for day traders?

The typical price is the average price at which a stock trades during a particular time period, typically calculated as the average of the high, low, and closing prices. In risk management for day traders, the typical price can play an important role in several ways:

- Entry and exit points: Day traders often use the typical price to determine when to enter or exit a trade. They may set specific price levels based on the typical price to place their stop-loss orders to limit potential losses or to take profit when the price reaches a certain level.

- Setting profit targets: Traders may use the typical price to set profit targets. This allows them to determine the potential upside based on the stock's historical price movement. By setting profit targets based on the typical price, day traders can manage their risk by aiming for achievable returns.

- Assessing volatility: Day traders need to understand the volatility of a stock before entering a trade. The typical price, being an average of different price levels, provides an indication of the overall range within which the stock trades. By considering the volatility associated with a particular typical price, traders can adjust their position size and risk accordingly.

- Technical analysis: The typical price is often used as one of many data points in technical analysis. Traders may analyze patterns, trends, and indicators alongside the typical price to make informed decisions. This analysis helps to identify potential risks, such as breakouts or reversals, and manage positions accordingly.

Overall, the typical price serves as a reference point for day traders in assessing risk, setting profit targets, determining entry and exit points, and understanding stock volatility. It helps traders make more informed decisions and manage their risk exposure effectively.