Best Technical Analysis Tools to Buy in February 2026

Options Trading: How to Turn Every Friday into Payday Using Weekly Options! Generate Weekly Income in ALL Markets and Sleep Worry-Free!

My Trading Journal - Premium Log Book for Stock Market, Forex, Options, Crypto - Guided Trading Journal with 80 Trades, 8 Review Sections - Ideal for Day Traders, Swing Traders, Position Traders

-

BOOST YOUR TRADING SUCCESS WITH DETAILED PERFORMANCE TRACKING.

-

RECORD 80 TRADES WITH INSIGHTS TO REFINE STRATEGIES AND PROFITS.

-

CUSTOMIZABLE SETUPS ENSURE TAILORED APPROACHES FOR EVERY TRADER.

![The Candlestick Trading Bible [50 in 1]: Learn How to Read Price Action, Spot Profitable Setups, and Trade with Confidence Using the Most Effective Candlestick Patterns and Chart Strategies](https://cdn.blogweb.me/1/51bi_Xy_Hc_Ob_L_SL_160_318bdc1e26.jpg)

The Candlestick Trading Bible [50 in 1]: Learn How to Read Price Action, Spot Profitable Setups, and Trade with Confidence Using the Most Effective Candlestick Patterns and Chart Strategies

![The Candlestick Trading Bible [50 in 1]: Learn How to Read Price Action, Spot Profitable Setups, and Trade with Confidence Using the Most Effective Candlestick Patterns and Chart Strategies](https://cdn.flashpost.app/flashpost-banner/brands/amazon.png)

![The Candlestick Trading Bible [50 in 1]: Learn How to Read Price Action, Spot Profitable Setups, and Trade with Confidence Using the Most Effective Candlestick Patterns and Chart Strategies](https://cdn.flashpost.app/flashpost-banner/brands/amazon_dark.png)

Gimly - Trading Chart (Set of 5) Pattern Posters, 350 GSM Candle Chart Poster, Trading Setup Kit for Trader Investor, (Size : 30 x 21 CM, Unframed)

- HIGH-QUALITY 350 GSM PAPER ENSURES DURABILITY FOR DAILY USE.

- GLOSS FINISH ENHANCES VISIBILITY OF PATTERNS FOR EASY ANALYSIS.

- PERFECT FOR STOCK AND CRYPTO TRADERS SEEKING INSTANT REFERENCE!

Trading Journal: Guided trading journal, trading log book & investment journal. 300 pages to track psychologic patterns, manage risk and improve trade after trade. Compatible with crypto, stocks and forex market

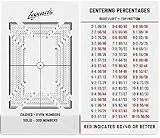

Legends Card Grading Centering Tool with Cleaning Cloth Kit Material for PSA - BGS - Graded Card Submissions Card Center Tool

Day Trading Flash Cards - Stock Market Chart & Candlestick Patterns, Instructions to Trade Like a Pro!

- MASTER CHART PATTERNS QUICKLY WITH PORTABLE, HIGH-QUALITY FLASH CARDS.

- LEARN TRADING STRATEGIES FOR ALL SKILL LEVELS-BEGINNER TO PRO.

- GAIN CONFIDENCE IN MAKING SWIFT, PROFITABLE TRADING DECISIONS DAILY.

How To Swing Trade: A Beginner’s Guide to Trading Tools, Money Management, Rules, Routines and Strategies of a Swing Trader

Technical analysis is a method of evaluating and predicting the future price movements of financial instruments based on historical price data and trading volume. This analysis relies on the assumption that price movements follow recognizable patterns and trends that can be identified and exploited for profit.

Traders can leverage technical analysis in their trading strategies by using various tools and indicators to analyze price charts and make informed trading decisions. Common techniques used in technical analysis include identifying support and resistance levels, trend lines, moving averages, and chart patterns such as head and shoulders, triangles, and flags.

By using these tools, traders can identify potential entry and exit points, set stop-loss orders to manage risk, and determine optimal profit targets. Technical analysis can help traders recognize when to buy or sell a financial instrument based on price movements and market conditions.

It is important for traders to understand that technical analysis is not foolproof and should be used in conjunction with other forms of analysis, such as fundamental analysis, to develop a well-rounded trading strategy. Additionally, traders should have a solid understanding of the tools and indicators they are using, as well as the limitations and potential drawbacks of technical analysis.

How to differentiate between noise and true signals in technical analysis?

Differentiating between noise and true signals in technical analysis can be challenging, as both can appear similar at times. However, there are some strategies that traders can use to help distinguish between the two:

- Look for confirmation: One way to differentiate between noise and true signals is to look for confirmation from multiple indicators or sources. If a signal is supported by various indicators or patterns, it is more likely to be a true signal rather than noise.

- Consider the timeframe: Noise tends to be more prevalent on shorter timeframes, while true signals may be more pronounced on longer timeframes. Consider looking at different timeframes to get a clearer picture of the overall trend.

- Analyze volume: Volume can provide valuable insight into whether a signal is noise or a true signal. A true signal is typically accompanied by an increase in trading volume, while noise may occur with low or inconsistent volume.

- Avoid overtrading: Traders who trade frequently may be more susceptible to reacting to noise rather than true signals. Avoiding overtrading and sticking to a consistent trading strategy can help filter out noise.

- Backtest your strategies: Backtesting your trading strategies can help identify patterns and signals that are more likely to be true signals rather than noise. By testing your strategies on historical data, you can gain a better understanding of what signals to look for.

Ultimately, it is essential to approach technical analysis with a critical mindset and to be aware of the limitations and biases that may influence your perception of signals. By utilizing multiple sources of information, considering the timeframe, analyzing volume, avoiding overtrading, and backtesting your strategies, you can better differentiate between noise and true signals in technical analysis.

What is the role of moving averages crossover in technical analysis?

Moving averages crossover is a popular technical analysis tool used by traders to identify potential trend reversals or confirm existing trends in the market. The crossover occurs when a shorter-term moving average crosses above or below a longer-term moving average, indicating a change in momentum and potentially signaling a buy or sell signal.

The role of moving averages crossover in technical analysis is to help traders identify entry and exit points in the market based on the direction of the crossover. When the shorter-term moving average crosses above the longer-term moving average, it is known as a bullish crossover and is considered a buy signal. Conversely, when the shorter-term moving average crosses below the longer-term moving average, it is known as a bearish crossover and is considered a sell signal.

Traders use moving averages crossovers in combination with other technical indicators to confirm signals and make informed trading decisions. By paying attention to moving averages crossovers, traders can potentially capitalize on short-term price movements and take advantage of trends in the market.

What is the function of the Relative Strength Index (RSI) in trading?

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. It is used by traders to determine overbought or oversold conditions in an asset, which can indicate potential reversal points in price trends. Traders use the RSI to identify when an asset is likely to be overvalued (overbought) or undervalued (oversold), and make decisions on when to buy or sell based on these signals. Additionally, the RSI can be used to confirm the strength of a trend or identify potential trend reversals.

What is the relationship between price and volume in technical analysis?

In technical analysis, the relationship between price and volume is considered crucial in predicting future price movements. Generally, technical analysts believe that when there is a significant change in the price of an asset, the trading volume should also increase.

If the price of an asset is increasing along with rising trading volume, it is considered to be a bullish sign, indicating that there is strong buying interest in the market and a potential uptrend may continue. On the other hand, if the price is falling with increased trading volume, it suggests that there is strong selling pressure and a potential downtrend may continue.

Conversely, if the price is moving in one direction with low trading volume, it may indicate weak momentum and a possible reversal of the current trend.

In summary, the relationship between price and volume in technical analysis is used to confirm the strength or weakness of a price trend and to identify potential buying or selling opportunities.