Best Trading Strategy Tools to Buy in March 2026

Options Trading: How to Turn Every Friday into Payday Using Weekly Options! Generate Weekly Income in ALL Markets and Sleep Worry-Free!

My Trading Journal - Premium Log Book for Stock Market, Forex, Options, Crypto - Guided Trading Journal with 80 Trades, 8 Review Sections - Ideal for Day Traders, Swing Traders, Position Traders

-

TRACK EVERY TRADE TO ENHANCE PERFORMANCE AND DECISION-MAKING SKILLS.

-

RECORD GUIDED TRADES TO REFINE STRATEGIES AND MAXIMIZE YOUR PROFITS.

-

TAILOR SETUPS AND ADJUST STRATEGIES BASED ON REAL MARKET CONDITIONS.

![The Candlestick Trading Bible [50 in 1]: Learn How to Read Price Action, Spot Profitable Setups, and Trade with Confidence Using the Most Effective Candlestick Patterns and Chart Strategies](https://cdn.blogweb.me/1/51bi_Xy_Hc_Ob_L_SL_160_54ce1b9e90.jpg)

The Candlestick Trading Bible [50 in 1]: Learn How to Read Price Action, Spot Profitable Setups, and Trade with Confidence Using the Most Effective Candlestick Patterns and Chart Strategies

![The Candlestick Trading Bible [50 in 1]: Learn How to Read Price Action, Spot Profitable Setups, and Trade with Confidence Using the Most Effective Candlestick Patterns and Chart Strategies](https://cdn.flashpost.app/flashpost-banner/brands/amazon.png)

![The Candlestick Trading Bible [50 in 1]: Learn How to Read Price Action, Spot Profitable Setups, and Trade with Confidence Using the Most Effective Candlestick Patterns and Chart Strategies](https://cdn.flashpost.app/flashpost-banner/brands/amazon_dark.png)

Gimly - Trading Chart (Set of 5) Pattern Posters, 350 GSM Candle Chart Poster, Trading Setup Kit for Trader Investor, (Size : 30 x 21 CM, Unframed)

- VIBRANT 12X8 PATTERNS IDEAL FOR STOCK & CRYPTO TRADERS.

- PREMIUM 350 GSM PAPER ENSURES DURABILITY & QUALITY.

- GLOSS FINISH ENHANCES VISIBILITY; PERFECT FOR STUDY & DISPLAY!

Trading Journal: Guided trading journal, trading log book & investment journal. 300 pages to track psychologic patterns, manage risk and improve trade after trade. Compatible with crypto, stocks and forex market

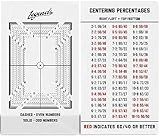

Legends Card Grading Centering Tool with Cleaning Cloth Kit Material for PSA - BGS - Graded Card Submissions Card Center Tool

Day Trading Flash Cards - Stock Market Chart & Candlestick Patterns, Instructions to Trade Like a Pro!

- MASTER TRADING WITH 67 PATTERNS TAILORED FOR ALL SKILL LEVELS!

- DURABLE, PORTABLE CARDS FOR ON-THE-GO MARKET ANALYSIS AND LEARNING!

- LEARN KEY STRATEGIES TO BOOST CONFIDENCE AND MAKE WINNING TRADES!

How To Swing Trade: A Beginner’s Guide to Trading Tools, Money Management, Rules, Routines and Strategies of a Swing Trader

![The Candlestick Trading Bible: [3 in 1] The Ultimate Guide to Mastering Candlestick Techniques, Chart Analysis, and Trader Psychology for Market Success](https://cdn.blogweb.me/1/41e_Ap_i_Cp_LL_SL_160_2e91d96843.jpg)

The Candlestick Trading Bible: [3 in 1] The Ultimate Guide to Mastering Candlestick Techniques, Chart Analysis, and Trader Psychology for Market Success

![The Candlestick Trading Bible: [3 in 1] The Ultimate Guide to Mastering Candlestick Techniques, Chart Analysis, and Trader Psychology for Market Success](https://cdn.flashpost.app/flashpost-banner/brands/amazon.png)

![The Candlestick Trading Bible: [3 in 1] The Ultimate Guide to Mastering Candlestick Techniques, Chart Analysis, and Trader Psychology for Market Success](https://cdn.flashpost.app/flashpost-banner/brands/amazon_dark.png)

Developing effective trading strategies involves careful analysis of the market, understanding of different trading techniques, risk management, and continuous learning.

First, it is essential to conduct thorough research on the market, including the factors that influence prices and trends. This will help you identify potential opportunities and risks.

Next, you should choose a trading technique that aligns with your trading goals and risk tolerance. This could include day trading, swing trading, or trend following strategies.

Risk management is crucial in trading as it helps protect your capital and ensure long-term success. This involves setting stop-loss orders, diversifying your portfolio, and avoiding emotional decision-making.

Continuous learning is key to developing effective trading strategies. Stay updated on market trends, attend trading seminars, and learn from successful traders.

Lastly, it is important to test your trading strategies in a simulated trading environment before implementing them with real money. This will help you refine your strategies and identify any potential flaws before risking your capital.

How do you minimize trading costs and fees?

There are several ways to minimize trading costs and fees:

- Choose a low-cost brokerage: Research brokerage firms that offer low trading fees and commissions. Look for platforms that have competitive pricing and do not charge high account maintenance or inactivity fees.

- Trade infrequently: Limit your trading activity to reduce the number of transactions and associated fees. Avoid making frequent trades unless absolutely necessary.

- Invest in low-cost index funds or ETFs: Consider investing in low-cost index funds or exchange-traded funds (ETFs) that have lower expense ratios compared to actively managed funds. These funds typically have lower trading costs and fees.

- Utilize discount brokers or commission-free trading platforms: Some brokerage firms offer commission-free trading for certain securities, reducing the costs associated with buying and selling stocks, ETFs, and options.

- Take advantage of promotional offers and discounts: Keep an eye out for promotions or discounts offered by brokerage firms for new account openings or trades. These offers can help reduce trading costs and fees.

- Use limit orders: When placing trades, consider using limit orders instead of market orders. Limit orders allow you to set a specific price at which you are willing to buy or sell a security, potentially reducing the impact of market fluctuations and minimizing trading costs.

- Monitor and review your trades: Regularly review your trading activity and performance to identify any unnecessary costs or fees. By staying informed and making informed decisions, you can minimize trading costs and optimize your investment strategy.

What is the role of indicators in developing trading strategies?

Indicators play a crucial role in developing trading strategies by providing traders with valuable information about current market trends, price movements, and potential entry and exit points for trades. By using indicators, traders can analyze historical data and identify patterns in market behavior that can help them make more informed trading decisions.

Some common indicators used in developing trading strategies include moving averages, Relative Strength Index (RSI), MACD, Bollinger Bands, and Fibonacci retracement levels. These indicators help traders identify when a particular asset is overbought or oversold, when trends are about to reverse, or when it might be a good time to enter or exit a trade.

Overall, indicators serve as important tools for traders to analyze and interpret market data, identify potential opportunities, and manage risk effectively when developing trading strategies.

What is the significance of staying updated with financial news?

Staying updated with financial news is significant for several reasons:

- Making Informed Decisions: Financial news provides information about the state of the economy, stock market trends, and changes in interest rates, inflation, and other key economic indicators. By staying informed, you can make better decisions about your investments, savings, and overall financial well-being.

- Identifying Opportunities: Financial news can alert you to potential investment opportunities, emerging markets, and new developments in industries that could affect your financial portfolio. By staying updated, you can capitalize on these opportunities and potentially increase your wealth.

- Managing Risk: Financial news can also help you identify and assess potential risks to your investments. By staying informed about market trends, economic developments, and geopolitical events, you can take proactive steps to protect your assets and minimize losses during periods of volatility.

- Planning for the Future: Financial news can provide insights into long-term trends, such as changes in retirement planning, tax laws, and estate planning strategies. By staying updated, you can adequately prepare for future financial challenges and opportunities.

- Building Financial Literacy: Regularly following financial news can help you improve your understanding of economic concepts, investment strategies, and personal finance topics. This can empower you to make more informed decisions about your money and build a solid financial foundation for the future.

What is the significance of staying informed about global markets?

Staying informed about global markets is significant for several reasons:

- Understanding global markets helps individuals and businesses make informed decisions about where to invest their money. By tracking market trends and developments, they can identify opportunities for growth and minimize risks.

- Being informed about global markets allows individuals and businesses to anticipate potential challenges and adjust their strategies accordingly. This can help them stay competitive in an increasingly interconnected world economy.

- Global markets are interconnected, so events in one market can have ripple effects on others. By staying informed, individuals and businesses can better understand how global events may impact their investments and operations.

- Staying informed about global markets also helps individuals and businesses stay ahead of emerging trends and technologies. This can give them a competitive edge and help them adapt to changing market conditions.

Overall, being informed about global markets is crucial for making informed decisions, identifying opportunities, and staying competitive in today's rapidly changing business environment.

How do you incorporate fundamental analysis into your trading strategy?

Incorporating fundamental analysis into a trading strategy involves analyzing various economic, financial, and industry data to gain insights into the underlying value of a security.

Here are some ways to incorporate fundamental analysis into your trading strategy:

- Analyzing company financial statements: Analyze the financial statements of a company, such as its balance sheet, income statement, and cash flow statement, to assess its financial health and performance.

- Assessing industry trends: Study industry trends, market dynamics, and competitive landscape to understand the broader market context in which a company operates.

- Economic indicators: Monitor economic indicators, such as GDP growth, inflation, unemployment rates, and interest rates, to gauge the overall health of the economy and identify potential opportunities or risks.

- Company news and events: Stay updated on company news, earnings reports, product launches, developments in the regulatory environment, and other events that can impact the stock price.

- Valuation techniques: Use various valuation techniques, such as discounted cash flow analysis, price-to-earnings ratio, and price-to-book ratio, to determine whether a security is undervalued or overvalued.

- Risk management: Consider the risks associated with the investment, such as industry risks, regulatory risks, and company-specific risks, and incorporate appropriate risk management strategies into your trading plan.

By incorporating fundamental analysis into your trading strategy, you can make more informed investment decisions based on a thorough understanding of the underlying value and potential risks of the securities you are trading.

How to develop a disciplined trading approach?

- Set clear and specific trading goals: Define your trading objectives, whether it's to generate consistent profits, build wealth over time, or simply enjoy the process of trading. Having clear goals will help you stay focused and disciplined in your trading approach.

- Create a trading plan: A trading plan outlines your trading strategy, risk management guidelines, and rules for entering and exiting trades. Having a well-defined plan will help you make rational decisions and avoid emotional trading.

- Stick to your trading plan: It's important to follow your trading plan consistently, even when emotions are running high. Avoid making impulsive decisions or deviating from your plan based on market fluctuations.

- Practice patience: Trading requires patience and discipline. Avoid the temptation to chase profits or take unnecessary risks. Stick to your strategy and be patient for the right opportunities to present themselves.

- Manage risk effectively: Risk management is crucial in trading, as it helps protect your capital and minimize losses. Set stop-loss orders, position sizing rules, and risk-to-reward ratios to ensure that you are managing your risk effectively.

- Keep a trading journal: Keeping a trading journal can help you track your progress, evaluate your trades, and identify patterns in your decision-making. By reviewing your journal regularly, you can refine your trading approach and improve your overall performance.

- Continuously educate yourself: The trading landscape is always evolving, so it's important to stay informed and continuously educate yourself on new strategies, techniques, and market trends. This will help you adapt to changing market conditions and stay disciplined in your trading approach.