Best Fibonacci Extension Tools in Lua to Buy in February 2026

Golden Ratio, Fibonacci & Rule of Thirds Composition Tool Credit Card-Sized View Finder/Viewer for Photography, Painting, Drawing - Fits in Wallet or Camera Bag

- PREMIUM WATERPROOF DESIGN FOR ALL-WEATHER PROTECTION.

- TRUSTED NITARU BRAND ENSURES QUALITY AND RELIABILITY.

- ELEVATE YOUR ADVENTURES WITH UNBEATABLE WATERPROOF GEAR!

NYC Photo Safari: Golden Triangle + Fibonacci + Rule of Thirds Composition Tools View Finder/Viewer Photography/Painting/Drawing Credit Card Size Fits in Wallet/Camera Bag (Bundle)

- COMPACT DESIGN FITS WALLETS & BAGS-PERFECT FOR ARTISTS ON THE GO!

- UNIQUE COMPOSITION TOOLS FOR PHOTOGRAPHERS & PLEIN AIR ARTISTS.

- ENCOURAGES OUTDOOR CREATIVITY-GREAT ALTERNATIVE TO SCREEN TIME!

(11 Pcs) JJC Composition Viewfinder View Catcher Tool, Golden Ratio Fibonacci Spiral Rule of Thirds Leading Lines Card Composition View Finder for Artists Photographer Painter Sketchers

- MASTER COMPOSITION WITH 4 ESSENTIAL FINDER CARDS FOR PERFECT VISUALS.

- STYLISH LEATHER HOLDER KEEPS CARDS ORGANIZED AND EASILY ACCESSIBLE.

- DURABLE, LIGHTWEIGHT DESIGN ENSURES CLARITY AND PORTABILITY ON-THE-GO.

BLUKSYBU Fibonacci View Finder for Artists & Photographers - Golden Ratio Viewer - Fibonacci Composition View Finder | ViewFinder Golden Ratio Tool - Photography/Painting/Drawing Toolsuksybu

-

COMPACT & PORTABLE: FITS IN WALLETS/CAMERA BAGS FOR ON-THE-GO CREATIVITY.

-

MASTER COMPOSITION: ACHIEVE PERFECT SHOTS USING THE GOLDEN RATIO TOOLS.

-

UNIQUE GIFTS: IDEAL STOCKING STUFFERS FOR ARTISTS AND PHOTOGRAPHERS ALIKE!

CLPA Fibonacci Spiral Stencil Template for Drawing and Drafting: A Fibonacci Spiral Drawing Tool for Artists Allows The Simple Application of The Golden or Divine Ratio for Artistic Design

Golden Ruler Designer Brass Wallet Fibonacci Sequence/Series Ratio Multi Tool Essential Metal Card 3.25"x2" (Gold)

- ELEGANT BRASS RULER COMBINES FIBONACCI BEAUTY WITH UTILITY.

- STYLISH MULTITOOL PERFECT FOR DESIGNERS, DRAFTERS, AND CREATIVES.

- COMPACT AND PORTABLE DESIGN FOR ON-THE-GO DRAWING AND DRAFTING.

10 Pcs View Finder Golden Ratio Composition Tool, Golden Triangle Fibonacci Rule of Thirds Composition Tools Credit Card-Sized View Tool for Photography Painting Drawing Fits in Wallet or Camera Bag

- MASTER COMPOSITION TECHNIQUES WITH 10 ESSENTIAL FRAMING CARDS!

- STAY ORGANIZED AND PORTABLE WITH A CONVENIENT CARRY STRAP.

- DURABLE ACRYLIC DESIGN ENSURES CRYSTAL CLARITY IN YOUR VISUALS.

CLPA 12 Inch Flexible No-Math Fibonacci Clear Plastic Ruler: Masterful Design Meets Mathematical Ease

- ELEVATE DESIGNS WITH THE GOLDEN RATIO FOR STUNNING AESTHETICS!

- VERSATILE 12-INCH RULER: PERFECT FOR ALL CREATIVE PROJECTS!

- DURABLE AUSTRALIAN CRAFTSMANSHIP FOR LONG-LASTING PRECISION!

LUAATT Golden Ratio Viewer,2 Pack Portable Fibonacci Composition View Finder,Photography Scale Viewing Tool,Credit Card Size

- MASTER COMPOSITION EFFORTLESSLY WITH FIBONACCI RATIO GUIDES!

- DURABLE, TRANSPARENT DESIGN FOR PRECISE GOLDEN RATIO FRAMING.

- PORTABLE SIZE FITS EASILY IN WALLETS OR CAMERA BAGS!

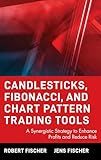

Candlesticks, Fibonacci, and Chart Pattern Trading Tools: A Synergistic Strategy to Enhance Profits and Reduce Risk

Fibonacci extensions in Lua are a commonly used tool in technical analysis to determine potential levels of support and resistance in financial markets. The Fibonacci extension levels are used to predict where prices may move to following a price retracement. By applying the Fibonacci ratios to key points on a price chart, traders can identify levels where a financial instrument may potentially reverse or continue its trend. These levels are used to set profit targets or to anticipate potential areas of price reversal. In Lua, Fibonacci extensions can be easily calculated using simple mathematical formulas and are commonly used by traders to make informed trading decisions.

What is the Fibonacci spiral and its relationship to extensions in Lua?

The Fibonacci spiral is a geometric shape derived from the Fibonacci sequence, a series of numbers in which each number is the sum of the two preceding ones. When these numbers are connected in a certain way, they form a spiral shape that is found in nature and has been used in art and design.

In Lua, extensions can be used to create and manipulate geometric shapes, such as the Fibonacci spiral. By using mathematical functions and algorithms, developers can generate the points that make up the spiral and draw it on the screen using Lua's graphics capabilities. Extensions in Lua allow for greater flexibility and customization when working with geometric shapes, making it easier to create complex and intricate designs like the Fibonacci spiral.

How to incorporate Fibonacci extensions into risk management techniques in Lua?

Fibonacci extensions can be used in risk management by setting profit targets based on key Fibonacci levels. Here is an example of how you can incorporate Fibonacci extensions into risk management techniques in Lua:

- Calculate the Fibonacci extensions levels for a given price move. This can be done by identifying the swing high and low points and applying the Fibonacci ratios (e.g. 0.618, 1.000, 1.618) to determine potential price targets.

- Once the Fibonacci extension levels have been identified, set profit targets based on these levels. For example, you may decide to take profits at the 1.618 extension level, which is commonly used as a potential target for trend continuation.

- Use stop-loss orders to manage risk and protect your capital. You can place stop-loss orders below swing lows or key support levels to limit potential losses in case the trade goes against you.

- Monitor the price action and adjust your risk management strategy accordingly. If the price reaches a Fibonacci extension level and shows signs of reversal, consider taking profits or adjusting your stop-loss levels to protect your profits.

By incorporating Fibonacci extensions into your risk management techniques in Lua, you can set clear profit targets and manage your risk effectively in trading and investing activities.

How to adjust Fibonacci extension levels based on volatility in Lua?

To adjust Fibonacci extension levels based on volatility in Lua, you can calculate the average true range (ATR) and use it to modify the Fibonacci extension levels. Here's a sample Lua code to demonstrate this:

function calculateATR(data, period) local atr = {} atr[period] = 0

for i = period + 1, #data do

local tr = math.max(data\[i\].high - data\[i\].low, math.abs(data\[i\].high - data\[i - 1\].close), math.abs(data\[i\].low - data\[i - 1\].close))

atr\[i\] = ((period - 1) \* atr\[i - 1\] + tr) / period

end

return atr

end

function adjustFibLevels(data, atr, fibLevels) local volatilityMultiplier = 1

for i = 1, #data do

local atrValue = atr\[i\]

if atrValue > 0 then

volatilityMultiplier = atrValue

for j, level in ipairs(fibLevels) do

fibLevels\[j\] = level \* volatilityMultiplier

end

end

end

return fibLevels

end

-- Sample data local data = { {high = 10, low = 5, close = 8}, {high = 12, low = 6, close = 9}, {high = 15, low = 7, close = 11} }

local period = 14 local fibLevels = {0, 0.236, 0.382, 0.618, 1.0}

local atr = calculateATR(data, period) local adjustedFibLevels = adjustFibLevels(data, atr, fibLevels)

-- Print the adjusted Fibonacci levels for i, level in ipairs(adjustedFibLevels) do print(string.format("Fib Level %d: %.4f", i, level)) end

In this code snippet, we first calculate the Average True Range (ATR) using the given data and a specified period. Then we adjust the Fibonacci extension levels based on the ATR values. The adjustFibLevels function takes the data, ATR values, and the original Fibonacci levels as input, and returns the adjusted Fibonacci levels.

You can customize this code further based on your specific requirements or trading strategy.

What is the historical background of Fibonacci extensions in Lua?

Fibonacci extensions are a popular technical analysis tool used in the financial markets to identify potential levels of future support and resistance. The concept of Fibonacci extensions is based on the Fibonacci sequence, a mathematical sequence discovered by the Italian mathematician Leonardo of Pisa, also known as Fibonacci, in the 13th century.

The Fibonacci sequence is a series of numbers in which each number is the sum of the two preceding numbers, starting with 0 and 1. The sequence goes like this: 0, 1, 1, 2, 3, 5, 8, 13, 21, and so on. The ratio between two consecutive numbers in the sequence approximates the golden ratio, which is approximately 1.618.

Traders and analysts have found that these Fibonacci ratios often appear in the movements of financial markets, and they use them to predict potential levels of support and resistance. Fibonacci extensions are used to identify potential price targets for a security's price movement after a significant trend. They are typically drawn by connecting a significant low to a significant high (or vice versa) and projecting the potential extension levels based on the Fibonacci ratios.

In Lua, a programming language commonly used for scripting in financial markets, Fibonacci extensions can be implemented using mathematical functions to calculate the extension levels based on the Fibonacci ratios. Traders and analysts can then use these extension levels to make informed decisions about potential entry and exit points in the market.