Best Tools and Guides to Buy in February 2026

Options Trading: How to Turn Every Friday into Payday Using Weekly Options! Generate Weekly Income in ALL Markets and Sleep Worry-Free!

My Trading Journal - Premium Log Book for Stock Market, Forex, Options, Crypto - Guided Trading Journal with 80 Trades, 8 Review Sections - Ideal for Day Traders, Swing Traders, Position Traders

- TRACK AND ANALYZE TRADES TO ENHANCE PERFORMANCE AND DECISIONS.

- RECORD 80 GUIDED TRADES TO REFINE STRATEGIES AND MAXIMIZE PROFITS.

- DURABLE, PREMIUM JOURNAL PERFECT FOR DAILY USE BY ALL TRADERS.

![The Candlestick Trading Bible [50 in 1]: Learn How to Read Price Action, Spot Profitable Setups, and Trade with Confidence Using the Most Effective Candlestick Patterns and Chart Strategies](https://cdn.blogweb.me/1/51bi_Xy_Hc_Ob_L_SL_160_70724ac62e.jpg)

The Candlestick Trading Bible [50 in 1]: Learn How to Read Price Action, Spot Profitable Setups, and Trade with Confidence Using the Most Effective Candlestick Patterns and Chart Strategies

![The Candlestick Trading Bible [50 in 1]: Learn How to Read Price Action, Spot Profitable Setups, and Trade with Confidence Using the Most Effective Candlestick Patterns and Chart Strategies](https://cdn.flashpost.app/flashpost-banner/brands/amazon.png)

![The Candlestick Trading Bible [50 in 1]: Learn How to Read Price Action, Spot Profitable Setups, and Trade with Confidence Using the Most Effective Candlestick Patterns and Chart Strategies](https://cdn.flashpost.app/flashpost-banner/brands/amazon_dark.png)

Gimly - Trading Chart (Set of 5) Pattern Posters, 350 GSM Candle Chart Poster, Trading Setup Kit for Trader Investor, (Size : 30 x 21 CM, Unframed)

- DURABLE 350 GSM PAPER ENSURES LONG-LASTING QUALITY.

- GLOSS FINISH ENHANCES READABILITY FOR EASY PATTERN ANALYSIS.

- PERFECT FOR STOCK AND CRYPTO TRADERS-BOOST YOUR MARKET INSIGHT!

Trading Journal: Guided trading journal, trading log book & investment journal. 300 pages to track psychologic patterns, manage risk and improve trade after trade. Compatible with crypto, stocks and forex market

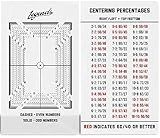

Legends Card Grading Centering Tool with Cleaning Cloth Kit Material for PSA - BGS - Graded Card Submissions Card Center Tool

Day Trading Flash Cards - Stock Market Chart & Candlestick Patterns, Instructions to Trade Like a Pro!

- MASTER TRADING WITH 20 CHART PATTERNS & 34 CANDLESTICK PATTERNS.

- PERFECT FOR ALL LEVELS: ENHANCE SKILLS FOR DAY, OPTIONS & SWING TRADING.

- DURABLE, PORTABLE CARDS FOR ON-THE-GO LEARNING & QUICK DECISION-MAKING.

How To Swing Trade: A Beginner’s Guide to Trading Tools, Money Management, Rules, Routines and Strategies of a Swing Trader

![The Candlestick Trading Bible: [3 in 1] The Ultimate Guide to Mastering Candlestick Techniques, Chart Analysis, and Trader Psychology for Market Success](https://cdn.blogweb.me/1/41e_Ap_i_Cp_LL_SL_160_c3debea39c.jpg)

The Candlestick Trading Bible: [3 in 1] The Ultimate Guide to Mastering Candlestick Techniques, Chart Analysis, and Trader Psychology for Market Success

![The Candlestick Trading Bible: [3 in 1] The Ultimate Guide to Mastering Candlestick Techniques, Chart Analysis, and Trader Psychology for Market Success](https://cdn.flashpost.app/flashpost-banner/brands/amazon.png)

![The Candlestick Trading Bible: [3 in 1] The Ultimate Guide to Mastering Candlestick Techniques, Chart Analysis, and Trader Psychology for Market Success](https://cdn.flashpost.app/flashpost-banner/brands/amazon_dark.png)

When refining entry and exit points in trading strategies, it is important to consider various technical indicators such as moving averages, RSI, MACD, and support/resistance levels. These indicators can help identify potential entry points when a stock or asset is oversold or overbought. Additionally, using multiple indicators can help confirm signals and reduce false entry points.

For exit points, it is essential to have a predefined profit target and stop-loss level in place to manage risk. Traders can use trailing stop-loss orders to lock in profits as the price moves in their favor. It is also important to consider market conditions and news events that can impact the price of the asset.

Overall, refining entry and exit points in trading strategies requires patience, discipline, and continuous analysis of market trends to make informed decisions and maximize profits while minimizing losses.

How to use Fibonacci retracement levels to refine entry and exit points?

Fibonacci retracement levels can be used to identify potential support and resistance levels in a market trend. This can help traders identify optimal entry and exit points for their trades. Here's how you can use Fibonacci retracement levels to refine your entry and exit points:

- Identify the trend: Before applying Fibonacci retracement levels, it's important to first identify the current trend in the market. You can do this by analyzing price action and determining whether the market is trending up or down.

- Draw Fibonacci retracement levels: Once you have identified the trend, you can draw Fibonacci retracement levels by selecting the swing high and swing low points of the trend. These levels are typically drawn at 23.6%, 38.2%, 50%, 61.8%, and 78.6% retracement levels.

- Look for potential support and resistance levels: Fibonacci retracement levels can help you identify potential support and resistance levels in the market. These levels can act as price targets for entering or exiting a trade. For example, if the price retraces to a Fibonacci level and holds as support, it can be a good entry point for a long trade. Conversely, if the price retraces to a Fibonacci level and encounters resistance, it might be a good time to exit a trade.

- Combine Fibonacci levels with other technical indicators: While Fibonacci retracement levels can be a useful tool for identifying entry and exit points, it's important to use them in conjunction with other technical indicators to confirm your trading decisions. You can use indicators such as moving averages, trendlines, and support and resistance levels to validate your trading signals.

- Manage risk: It's important to always have a risk management strategy in place when trading. Set stop-loss orders to limit your losses in case the trade goes against you, and always have a target profit level in mind when entering a trade.

By following these steps and using Fibonacci retracement levels in combination with other technical indicators, you can refine your entry and exit points and improve your trading performance.

What is the role of indicators in identifying entry and exit points?

Indicators play a crucial role in identifying entry and exit points in trading and investing.

Entry points: Indicators can help traders determine the best time to enter a trade by providing signals based on various technical factors such as price movements, volume, and momentum. For example, indicators like moving averages, RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and Bollinger Bands can be used to identify potential entry points when they show certain patterns or confirmations of a trend reversal.

Exit points: Similarly, indicators can also assist traders in determining when to exit a trade to lock in profits or cut losses. Indicators can provide signals for potential trend reversals or overbought/oversold conditions, signaling the optimal time to exit a position. For example, a trader might use the RSI indicator to identify when a stock is overbought and likely to see a reversal, prompting them to exit their position.

In summary, indicators help traders and investors make informed decisions about entry and exit points by providing signals and insights into market trends and conditions. It is important for traders to understand how to properly interpret and use indicators to maximize their effectiveness in identifying entry and exit points.

How to fine-tune entry and exit points through continuous learning and adaptation?

- Keep track of your trades: Record and review each of your trades to identify patterns and trends in your entry and exit points. This will help you understand what is working and what is not.

- Follow the market closely: Stay up-to-date with the latest market news and trends to make informed decisions about when to enter and exit trades. This will also help you anticipate potential market movements.

- Learn from mistakes: When a trade goes wrong, take the time to analyze why it happened and what you can learn from it. This will help you avoid making the same mistakes in the future.

- Experiment with different strategies: Try out different entry and exit strategies to see what works best for you. This could involve using technical analysis tools, setting stop-loss orders, or scaling in and out of positions.

- Seek feedback and advice: Talk to other traders, join trading communities, or seek out a mentor to get feedback on your trades and learn from their experiences.

- Be willing to adapt: Markets are constantly changing, so it is important to be flexible and willing to adapt your strategies based on new information and market conditions.

- Practice patience and discipline: Avoid making impulsive decisions based on emotions or short-term fluctuations in the market. Stick to your trading plan and be patient in waiting for the right entry and exit points to maximize your profit potential.